Backtesting an ETF Based Market Rotation Algo

Trading Strategies# ETF-Based Market Rotation Using Momentum: A Practical Overview ## Introduction Momentum strategies have become popular for their ability to ride market trends and help investors make smarter moves. One cool approach is using momentum to rotate between ETFs, which are easy-to-trade baskets of assets representing different sectors or markets.

## What is Momentum Rotation? Momentum rotation is about shifting your investments to ETFs that are showing strong recent performance, while moving away from those that aren’t keeping up. It’s like following the market’s current favorites to potentially boost returns.

## How Does It Work? The idea is pretty straightforward: - Look at how ETFs have performed over a recent period (like a few months)- Pick the top performers based on that momentum- Allocate your money to those ETFs, keeping some cash aside as a safety buffer- Regularly rebalance your portfolio to stay aligned with the latest momentum signals.

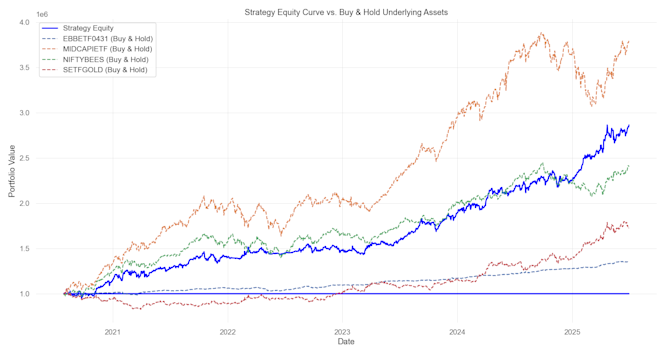

## Why ETFs? ETFs offer a simple way to diversify across sectors, countries, or asset classes without buying individual stocks. In our approach, we focus on a set of ETFs like EBBETF0431, MIDCAPIETF, NIFTYBEES, and SETFGOLD, which cover different market segments.

## Key Points to Keep in Mind - We keep a small cash reserve to manage risk.- The strategy is long-only, meaning it only buys ETFs and doesn’t short-sell.- Rebalancing happens on a set schedule, like monthly, to keep things systematic.- If none of the ETFs show positive momentum, the strategy can shift to a bond ETF as a safer option.

## Benefits of This Approach - Helps capture upward trends in the market- Avoids getting stuck in underperforming assets- Reduces emotional decision-making by following clear rules- Easy to implement with ETFs and regular rebalancing.

## Things to Watch Out For - Sideways markets can cause frequent changes and trading- Transaction costs might add up if rebalancing too often. AlphaBots signal Limitless considers these costs when backtesting- The choice of ETFs and lookback periods can impact results.

## Real-World Use This kind of momentum-based ETF rotation is great for investors who want a hands-off, rules-based way to stay invested in the best parts of the market while managing risk.

--- ## Research and Backtesting Approach This strategy is backed by extensive research using a multi-parameter backtest framework. We tested many combinations of key parameters like lookback periods, rebalance frequency, number of top ETFs to hold, and cash reserves. By running these combinations through historical data from 2020 to 2025, we identified the top-performing setups that balance returns, risk, and drawdowns. The backtest uses real ETF price data and simulates trades over time, capturing monthly returns and overall portfolio growth. This rigorous testing helps ensure the strategy is robust and adaptable to different market conditions.

## Creating Long-Term Wealth By systematically rotating into ETFs with strong momentum and managing risk with cash reserves and bonds, this approach aims to capture sustained upward trends while avoiding prolonged downturns. The multi-parameter backtest helps fine-tune the strategy for consistent performance. Over time, this disciplined, rules-based method can help investors build wealth by staying invested in the best parts of the market and reducing emotional decision-making.

--- *Note: This overview is for educational purposes and not investment advice. Always do your own research or consult a financial advisor before making investment decisions*