Experience Alphabots sleek array of features

Where innovation and elegance come together seamlessly

No Coding Required

Alphabots offers a no-code platform that makes it easy for retail investors to use our trading strategies without needing to code them or expertise in algorithmic trading.

Ultra Fast

Alphabots uses advanced tools to execute trades at ultra-fast speeds, which can be critical in fast-moving markets where timely execution is important.

End-to-end Automation

ⱍAlgos automates trades from start to finish, allowing them to be executed seamlessly without any manual intervention. Our team of experts monitors these strategies for additional surveillance.

Robust Simulations

Our algos simulate real-world scenarios by considering multiple factors like data quality, slippages, and outlier handling for enhanced accuracy.

Real-time monitoring

Alphabots team monitors all trading systems on a real-time basis. Thus making the entire process worry-free for the users.

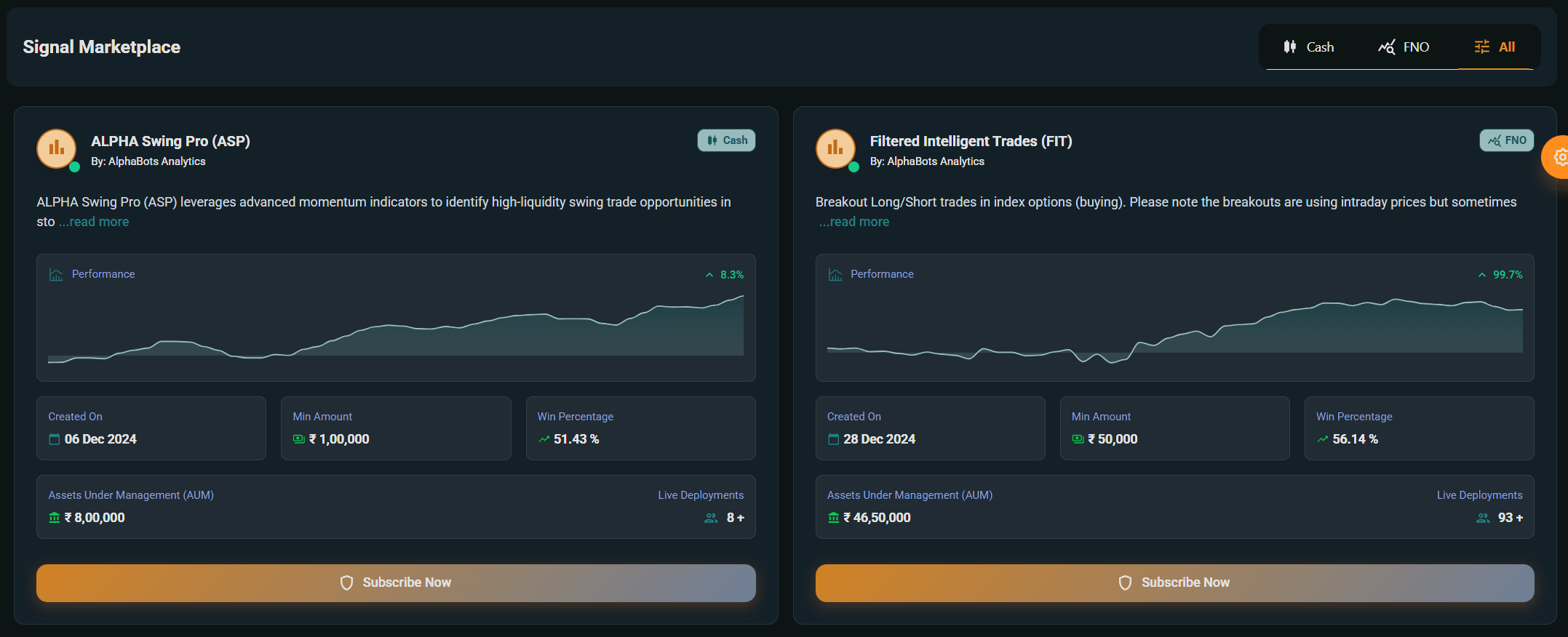

Personalised Signal Recommendations

With the help of our tools we help you select the best algo trading strategy from our marketplace which are tailored to your investment objectives and risk tolerance.

Alphabots Bridge

Connect Any Trading Tool to Any Broker

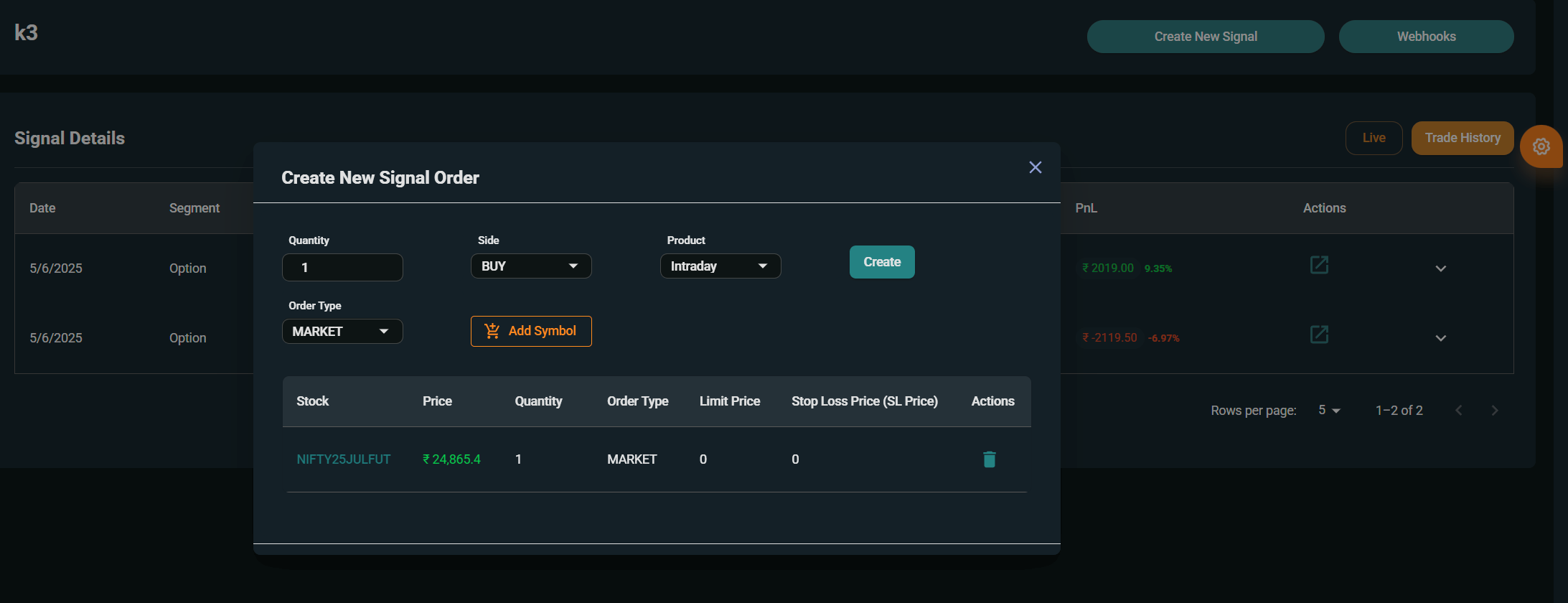

Webhook Integration

Connect any trading tool or programming language to your preferred broker through our robust webhook system.

Universal Compatibility

Works seamlessly with popular platforms like Amibroker, TradingView, Excel, Python, and more.

Automated Execution

Execute trades automatically with built-in risk management and real-time monitoring.

Secure & Reliable

Enterprise-grade security with encrypted connections and reliable order execution.

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 // © AlphaBots //@version=5 strategy("MA Crossover Strategy with SL/Target", overlay=true) // === Input Parameters === fastLength = input.int(20, title="Fast MA Length") slowLength = input.int(50, title="Slow MA Length") targetPct = input.float(2.0, title="Target %", step=0.1) stopPct = input.float(1.0, title="Stop Loss %", step=0.1) // === MA Calculation === fastMA = ta.sma(close, fastLength) slowMA = ta.sma(close, slowLength) // === Plot MAs === plot(fastMA, color=color.blue, title="Fast MA") plot(slowMA, color=color.red, title="Slow MA") // === User Messages Export === webhookUrl = input.string("[YOUR_WEBHOOK_URL]", "Webhook URL") webhookMessage = LongCondition = ta.crossover(fastMA, slowMA) ShortCondition = ta.crossunder(fastMA, slowMA) if (LongCondition) strategy.entry("Long", strategy.long) alert(str.tostring(webhookMessage), alert.freq_once_per_bar_close) if (ShortCondition) strategy.close("Long") alert(str.tostring(webhookMessage), alert.freq_once_per_bar_close)AI Tools

Powerful AI-driven tools to enhance your trading experience

AlphaBots AI Agent

Your personal AI trading assistant available 24/7 on Telegram

24/7 AI Support

Get instant answers to your trading questions anytime, anywhere

Available NowPortfolio Insights

Real-time analysis and recommendations for your investment portfolio

Available NowTrading Assistance

Expert guidance on trading strategies and market opportunities

Available NowMarket Updates

Stay informed with the latest market news and trends

Available NowStart Chatting with AlphaBots AI

Get instant trading insights, portfolio analysis, and market updates directly in Telegram.

MCP Server Integration

Connect your portfolio data with any LLM tool or IDE for intelligent trading insights

Real-time Portfolio Analysis

Get instant AI-powered insights on your portfolio performance across all connected brokers

Available NowCross-broker Data Integration

Seamlessly aggregate holdings and positions from multiple brokers into a unified view

Available NowLLM Tool Compatibility

Works with popular AI tools like ChatGPT, Claude, and other LLM platforms

Available NowIDE Integration

Direct integration with development environments for automated trading strategies

Available NowReady to Get Started?

Our MCP server is live and ready to integrate with your favorite AI tools and development environments.

Broker Insights

Real-time portfolio tracking across all your connected brokers

AngelOne

Zerodha

Upstox

Fyers

₹6,50,000

Total Portfolio Value

₹32,250

Total Profit

10

Active Positions

₹10,45,000

Total Available Margin

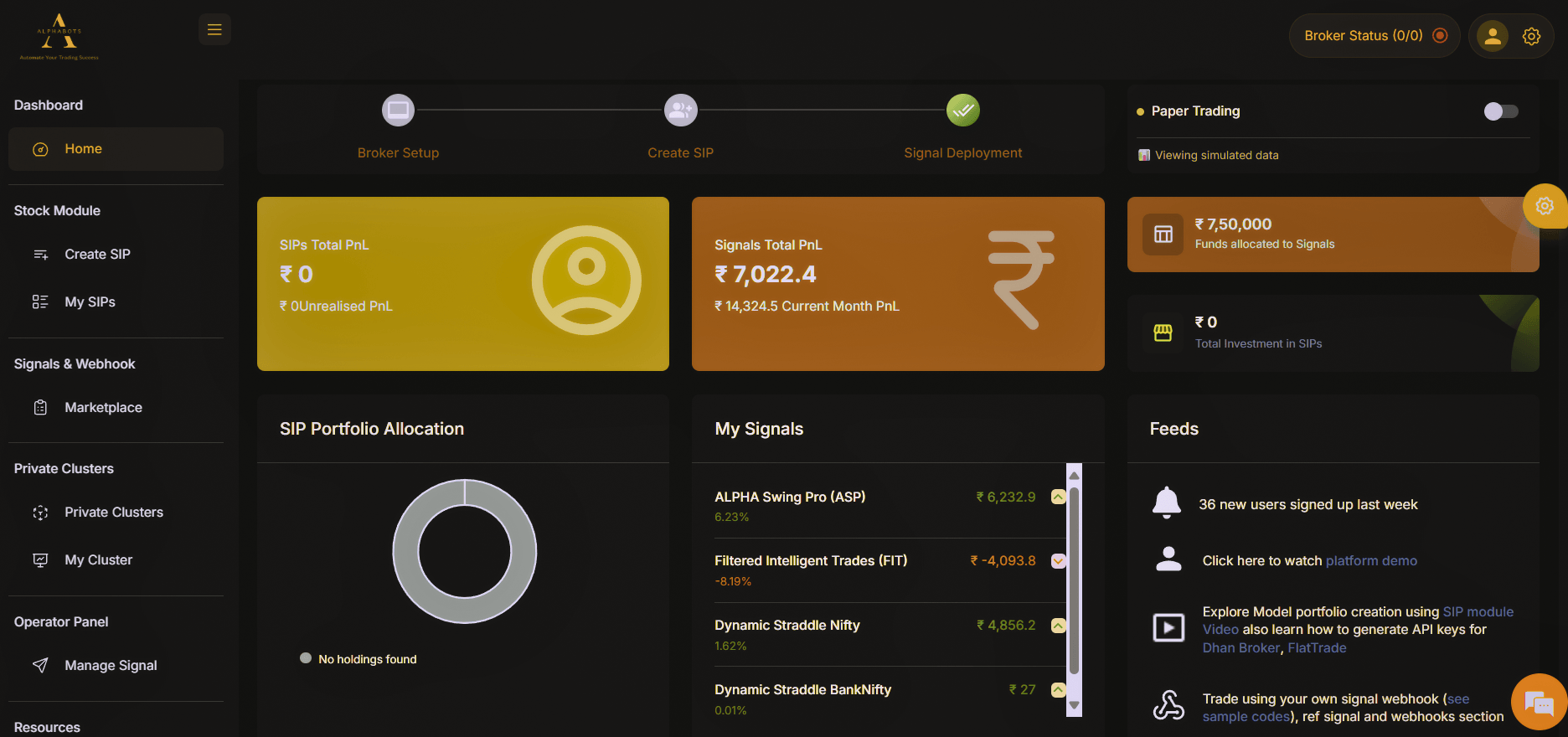

Portfolio Builder (SIP Module)

Systematic Investment Plans with Advanced Automation

ETF Averaging through Automated SIPs

Enables systematic ETF investments, benefiting from rupee cost averaging and reducing market timing risk.

Effortless Bulk Stock Purchases

Simplifies managing multiple stock orders by enabling easy creation and dynamic order execution for the entire portfolio.

Clone ready to use portfolios

Automate the buying process and run it once or setup daily/weekly/monthly SIPs

Blue-chip Stock Aggregate

Create personalized SIPs focusing on blue-chip stocks, investing in companies with strong financial stability and balance sheets.

For Sebi Registered Research Analyst

Professional-Grade Trading Solutions

Transparency and Tracking

Your skill and our infra to manage recommendations in a transparent way.

Advanced Execution

Order execution algorithms for automatic trading on research calls.

Portfolio Builder

Build and manage your custom portfolios with inbuilt tools.

You bring the skill.

We bring the capital.

Get funded starting from ₹500,000 in real capital. Trade like a pro. Scale like a quant.

Funded Account

No demo accounts

Trade with real capital from day one

No fluff

Simple, transparent rules and requirements

Real markets

Instant access to live trading

Monthly profits

Get your profit share every month