All About Stock Exchange.

Stock Market Basics

What is the stock exchange?

In India, the stock exchange functions as a marketplace where various financial instruments, including stocks, bonds, and commodities, are actively traded.

This platform serves as a meeting ground for buyers and sellers, facilitating the exchange of financial instruments within specific hours on any business day while adhering to the well-defined guidelines set forth by SEBI. Notably, participation in this trading arena is exclusive to companies listed on a stock exchange.

For stocks not featured on a recognized stock exchange, an alternative avenue exists in the form of the 'Over The Counter Market.' However, it's essential to note that shares traded through this channel might not garner the same level of esteem as those within the official stock exchange market.

How does stock exchange works?

Typically, an Indian stock exchange operates independently without the presence of 'market makers' or 'specialists.'

The trading process on the Indian stock exchange is primarily order-driven, conducted through an electronic limit order book. In this setup, orders are automatically matched using a trading computer, aligning investors' market orders with the most suitable limit orders.

The key advantage of this order-driven market is the promotion of transaction transparency, with all market orders being publicly displayed.

Brokers play a pivotal role in the stock exchange market's trading system, serving as the intermediaries through whom all orders are placed.

Both institutional investors and retail customers can leverage direct market access (DMA) to avail themselves of benefits. Utilizing the trading terminals provided by stock exchange market brokers, investors can directly place their orders into the trading system.

Benefits of Listing with Stock Exchange

Getting listed on a stock exchange comes with exclusive advantages for company securities. For example, only shares of companies that have undergone the listing process are featured on a stock exchange.

Being a part of a well-regarded stock exchange is considered advantageous for companies, investors, and the broader public. They stand to gain in the following manners:

1. Increased value

Stocks exclusively listed on a well-regarded stock exchange carry a perceived higher value. Companies can leverage their standing in the stock exchange arena by expanding their shareholder base. Introducing shares to the market for potential shareholders to acquire proves to be a powerful strategy for augmenting both shareholder numbers and base, subsequently enhancing their overall credibility.

2. Collateral value

Nearly all lending institutions acknowledge listed securities as collateral and offer credit facilities based on them. A company listed on the stock exchange stands a higher chance of securing swift approval for credit requests, given the perception of greater credibility within the stock exchange market.

3. Accessing capital

A highly efficient method for a company to access affordable capital involves releasing company shares in the stock exchange for potential shareholders to obtain. Listed companies can secure a more substantial amount of capital through share issuance due to their standing in the stock exchange market. This capital influx can be instrumental in sustaining the company and ensuring the continuity of its operations.

4. Fair price

The stated price also reflects the actual worth of a specific security in an Indian stock exchange.

Since the prices of listed securities are determined by the interplay of demand and supply forces and are openly disclosed, investors can confidently obtain them at an equitable price.

5. Liquidity

Being listed enables shareholders to harness superior liquidity compared to their counterparts, providing them with readily marketable options. It empowers shareholders to assess the value of their investments.

Furthermore, it facilitates seamless share transactions with the company, allowing shareholders to mitigate associated risks. It also empowers shareholders to enhance their earnings, even with the slightest uptick in the overall organizational value.

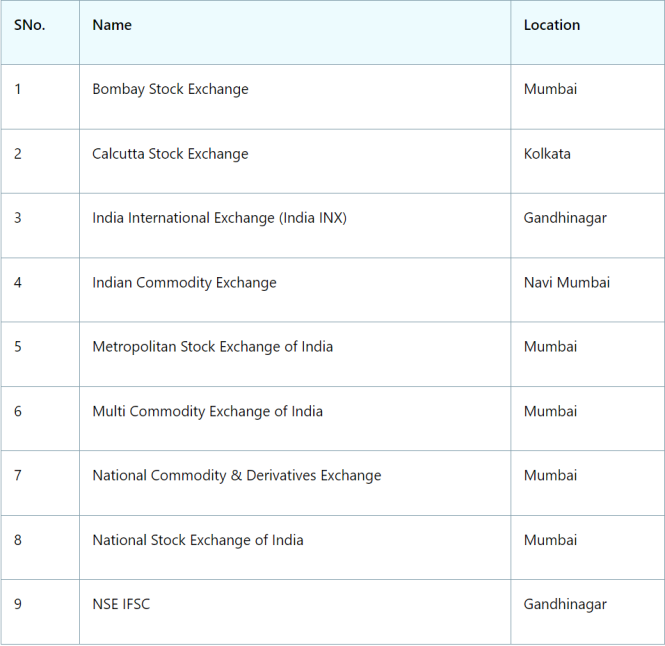

Major stock exchanges in India

India hosts two primary types of Stock Exchanges, namely:

Bombay Stock Exchange (BSE): Established in 1875 on Dalal Street, Mumbai, BSE is renowned as the oldest stock exchange in Asia and the 10th largest globally. Its estimated market capitalization, as of April, stands at $4.9 Trillion, boasting around 6000 publicly listed companies. The performance of BSE is benchmarked by the Sensex, which reached its pinnacle in June 2019, touching 40312.07.

National Stock Exchange (NSE): Founded in Mumbai in 1992, NSE is credited as the pioneer among demutualized electronic stock exchange markets in India. It was established with the aim of mitigating the monopolistic influence of the Bombay Stock Exchange in the Indian stock market. As of March 2016, NSE's estimated market capitalization was US$4.1 trillion, ranking it as the 12th largest stock exchange globally. NIFTY 50 serves as NSE's index, widely utilized by global investors to assess the performance of the Indian capital market.

Here is a list of stock exchanges in India :