Weekly-Market-Wrap-Up-Indian-and-Global-Markets-IPO-News-and-Sector-Insights

Other

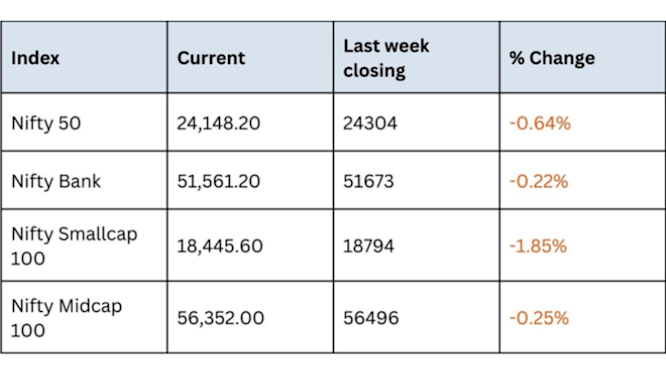

Indices snapshot

The Nifty 50, Nifty Bank, Nifty Smallcap 100, and Nifty Midcap 100 have experienced modest declines over the past week.

Key Highlights of the Week:

Indian Equity Markets Decline

Indian benchmarks, NIFTY50 and SENSEX, ended the week with modest losses of around 0.2%. The decline was driven by sustained selling from Foreign Institutional Investors (FIIs) and weaker-than-expected earnings reports. With investor sentiment subdued, the global economic environment and domestic challenges in key sectors played a significant role in this downturn.

US Presidential Election Outcome

Donald Trump’s victory as the 47th President of the United States introduced volatility to global markets, creating uncertainty regarding policies, trade relations, and investment flows. The leadership change could impact FII flows and market behaviour in India due to the strong economic ties between both countries.

Global Interest Rate Cuts

The Federal Reserve and Bank of England each announced a 25-basis-point rate cut, signaling a dovish stance aimed at economic stability. Speculation is growing about further rate cuts in December 2024, impacting global markets, including equity and currency markets.

FII Outflows

FIIs continued selling, pulling out Rs 4,888 crore from Indian equities on November 7 alone. This trend has contributed to the subdued performance in Indian markets, with major outflows from sectors like banking and financials.

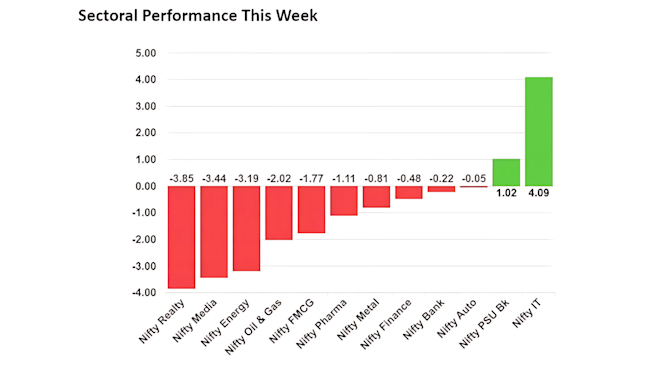

Sector Performance

NIFTY IT, PSU Bank, and Auto sectors posted gains, while Realty, Media, and Energy sectors were the biggest losers. This highlights a selective interest in sectors with stronger fundamentals and growth potential, while others face external challenges.

Broader Market Declines

The NIFTY Smallcap and Midcap indices saw drops of 1.8% and 0.2%, respectively, reflecting a broader market correction driven by profit-booking and macroeconomic concerns.

Bitcoin's Record-Breaking Inflows Post-Election

After the US election, Bitcoin saw inflows exceeding $2 billion into Bitcoin ETFs, with an additional $120 million into Ethereum ETFs. This surge reflects growing investor confidence in cryptocurrencies amid the political shift.

Impact of US Elections on Indian Markets

The US election outcome significantly influences Indian markets. The change in leadership and potential policy shifts under Donald Trump’s presidency could impact investor sentiment and FII flows, influencing market trends in the coming months.

Unlisted Share News

Swiggy’s Upcoming IPO:

Swiggy plans to raise Rs 11,330 crore through its IPO, with proceeds aimed at debt repayment and expanding dark stores and technology.

SBI Mutual Fund:

SBI Mutual Fund reported a record Rs 10.99 lakh crore in Average Assets Under Management (AAUM), driven by strong SIP contributions.

Yubi’s Revenue Growth:

Yubi’s revenue increased by 47.6% to Rs 484 crore, with operational efficiencies reducing losses by 22%.

Polymatech Electronics Investment:

The semiconductor manufacturer is investing $100 million in Bahrain to enhance regional tech capabilities.

Sectoral Highlights

Top Gainers of the Week:

NIFTY IT (+4.1%)

: Led by Tech Mahindra and key IT players.

NIFTY PSU Bank (+1.8%)

: Strong fundamentals supported gains in public sector banks.

NIFTY Auto (+1.2%)

: Positive growth reports drove the automotive sector higher.

Top Losers of the Week:

NIFTY Realty (-3.2%)

: High-interest rates and low demand affected the real estate sector.

NIFTY Media (-2.9%)

: Weak advertising revenues hurt media stocks.

NIFTY Energy (-2.3%): Declines in oil prices led to a negative trend in the energy sector.

Top Performing Stocks:

ARC Finance RE (+135.14%)

: The stock surged significantly.

Adinath Exim Resources (+65.13%)

: Positive momentum lifted the stock.

Top Declining Stocks:

Consolidated Construction Consortium (-21.65%)

: A sharp decline in stock value.

Shelter Infra Projects (-18.40%)

: Significant selling pressure led to a sharp drop.

Global Market News

European Markets Fall: European markets ended lower due to disappointing earnings from luxury companies like Richemont. Major indices saw declines:

FTSE 100 (UK)

: Down 0.66%.

CAC 40 (France)

: Dropped 0.8%.

DAX (Germany)

: Fell 0.67%.

Mixed Performance in Asian Markets:

Asian markets showed mixed performance, with reactions to global rate cuts. Investors are awaiting potential stimulus from China, contributing to cautious sentiment.

FII Outflows and Sectoral Impact on Indian Markets

October saw Rs 1,13,859 crore in FII outflows from Indian markets, particularly from banking, oil & gas, and FMCG sectors. This trend reflects caution amidst global uncertainties.

IPO Corner: Record-Breaking Year for Indian IPOs

India's IPO market has raised a record Rs 1.19 lakh crore in 2024, with notable upcoming IPOs like Swiggy and NTPC Green Energy. Despite subdued demand for recent listings, investor interest remains strong.

Swiggy:

The IPO has already been oversubscribed, with strong participation from institutional investors.

NTPC Green Energy:

Aiming to attract investment in the renewable energy space.

Mobikwik and PharmEasy:

Both companies are finalizing IPO plans in India’s growing fintech and healthcare sectors.

Crypto Markets: Record-Breaking Inflows and Bitcoin ETF Popularity

Bitcoin and Ethereum ETFs saw substantial inflows following the US election. Investors poured over $2 billion into Bitcoin ETFs and $120 million into Ethereum ETFs, indicating strong interest in digital assets.

Bitcoin Surge:

Bitcoin gained nearly 4% over the week.

Ethereum Stability:

Ethereum ETFs held steady, supported by strong inflows.

Commodity Markets Update

Gold and Silver:

Gold prices remained steady at Rs 56,500 per 10 grams, while silver dropped slightly to Rs 73,200 per kilogram.

Crude Oil:

Brent Crude traded at around $82 per barrel, with minimal fluctuations due to OPEC+ production cuts.

Key Takeaways and Outlook for the Coming Weeks:

Equity Markets:

Caution may continue in Indian and global markets, with close attention on rate decisions in December.

IPO Pipeline:

Upcoming IPOs like Swiggy's and NTPC Green Energy are expected to maintain investor interest.

Cryptocurrency Investments:

Strong institutional interest in crypto ETFs suggests greater acceptance of digital assets.

Sector-Specific Trends:

IT, Auto, and PSU Banks may remain attractive, while sectors like Real Estate and Energy could face volatility.

Analysts' Recommendations:

Banking & Financials:

Buy on dips due to strong long-term growth potential.

IT Sector:

Hold for global technology growth.

Energy & Metals:

Consider profit-booking in the short term.

Auto Sector:

Maintain a favourable outlook driven by strong consumer demand and electric vehicle growth.

To sum up

This week saw a mixed market performance, influenced by political developments, rate cuts, and IPO activity. While FIIs have been net sellers, the resilience of retail and domestic investors is helping stabilize Indian markets. Key sectors such as IT, Auto, and PSU Banks may continue to perform well amidst ongoing global uncertainty.

Img source: https://www.linkedin.com/pulse/weekly-market-wrapup-altius-investech-bctjc/?trackingId=%2Fh2bx5zuTwGGbfBQ2wWgcQ%3D%3D