Understanding the Spinning Top Candlestick Pattern

Trading Strategies

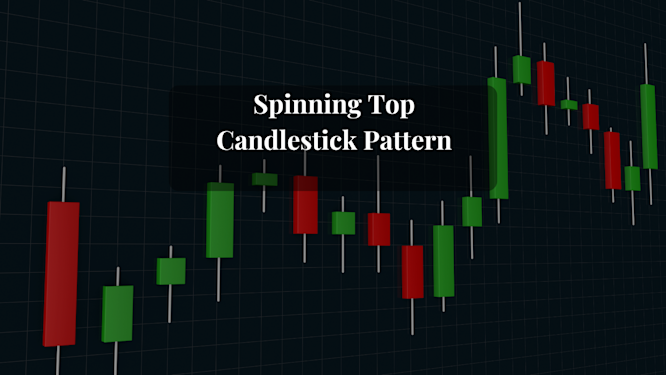

Definition of Spinning Top Candlestick

The spinning top is a popular candlestick pattern in technical analysis, recognized for its unique shape. This pattern consists of a small real body situated in the middle of long upper and lower shadows, indicating a lack of consensus between buyers and sellers. The small body reflects that the price did not move much from the open to the close during the specified time frame, while the long shadows on either side represent the volatility that occurred throughout the trading session.

A spinning top typically forms when there is a tug-of-war between the bulls and the bears, with neither side achieving a significant advantage. Although the price fluctuates significantly during the period, the open and closing prices end up close to each other, signaling indecision in the market. Traders interpret this pattern as a potential sign of a price reversal or continuation, depending on the surrounding market conditions and the candlestick that follows.

The spinning top is often found after a significant price movement, either upward or downward, and serves as a signal that the trend could be losing momentum. In the world of candlestick charting, this pattern is particularly useful in indicating periods of uncertainty or indecision.

Key Characteristics of the Spinning Top Candlestick pattern

A spinning top can be easily identified by its key features, including:

Small Real Body: The real body is small, showing minimal difference between the opening and closing prices. The body is the central area of the candlestick, and it indicates whether the price closed higher or lower than its opening price.

Long Upper and Lower Shadows: The upper and lower shadows are significantly longer than the body, which signifies that the price moved considerably higher and lower during the period but ultimately closed near the opening price.

Position of the Body: The body is vertically centered between the long shadows, representing equilibrium and balance between the forces of supply and demand.

Appearance: The overall shape of the candlestick resembles a spinning top toy, where the narrow real body is surrounded by elongated wicks or shadows.

This combination of a small body and long shadows is what gives the spinning top its distinct appearance and makes it an important pattern for traders to observe.

How Spinning Top Candlestick pattern Forms

Candlestick patterns are formed when the open, high, low, and close of an asset during a specific time period are recorded. A spinning top appears when there is a balance between the buying and selling pressures throughout the session. Both the bulls and the bears try to control the price, but neither is able to maintain dominance.

The Bulls: The bulls push the price higher, creating an upward movement during the trading period.

The Bears: The bears push the price lower, driving the price in the opposite direction.

The Close: Despite the strong movements in both directions, the final closing price ends up near the opening price.

This struggle between the two market forces—buyers and sellers—creates the spinning top pattern, which is characterized by price indecision. The more significant the movement of the price in both directions, the longer the shadows, further accentuating the sense of indecision.

What Do Spinning Top Candlesticks Signal?

Spinning top candlesticks are often viewed as signals of indecision in the market, as they reflect the inability of either side to assert dominance. However, while they generally indicate that the market is uncertain, the pattern can suggest different outcomes depending on where it appears and what follows it.

Here are the main interpretations of spinning top candlesticks:

Potential Reversal Signal:

Following a Strong Price Move: A spinning top can be seen as a reversal signal if it appears after a strong uptrend or downtrend. If the market has been moving in one direction for an extended period, the formation of a spinning top can indicate that the momentum is waning. A reversal may be imminent, but confirmation from the following candle is needed.

Uptrend to Downtrend: If the spinning top appears at the top of an uptrend, it can suggest that the bulls are losing control. The pattern indicates that the buyers' efforts to push prices higher were counteracted by the bears, and the trend may be about to reverse. If the next candle closes lower, it can confirm the reversal.

Downtrend to Uptrend: If the spinning top appears at the bottom of a downtrend, it may indicate that the bears are losing control. The bulls could be preparing to take over, and a reversal to the upside may follow. Confirmation comes when the next candlestick closes higher.

Indecision Within a Range:

Sideways Movement: A spinning top that appears within an established trading range usually signals that the market is undecided, and it may continue to move sideways. If the price action has been oscillating between a support and resistance level, a spinning top can reinforce the idea that the market is in a consolidation phase and could remain within that range.

Confirmation of Trend Continuation:

Sometimes, a spinning top doesn’t indicate a reversal but rather confirms that the trend will continue. If a spinning top appears after a significant uptrend or downtrend and is followed by another candlestick in the same direction, it may indicate that the trend is still strong, and the price will continue moving in the same direction.

Importance of Confirmation with Spinning Top Candlestick patterns

While the spinning top candlestick can suggest indecision or potential reversals, its significance is heightened when confirmed by the subsequent candle. Confirmation is critical in technical analysis because no single pattern can guarantee a specific outcome. The next candle plays a vital role in determining whether the pattern leads to a trend reversal or a continuation of the existing trend.

Bearish Reversal Confirmation: After a spinning top in an uptrend, a bearish candlestick (a candlestick that closes lower than its open) may confirm that the market is ready to reverse downward.

Bullish Reversal Confirmation: After a spinning top in a downtrend, a bullish candlestick (a candlestick that closes higher than its open) may confirm a reversal upward.

Indecision Confirmation: If the price remains within the range established before the spinning top, the pattern simply reinforces the idea that the market is in a phase of indecision and will likely continue moving sideways.

Example of Spinning Top Candlestick pattern in Action

To understand the concept of a spinning top more clearly, let’s look at a few examples:

Post-Decline Spinning Top: Suppose the price has recently declined, and a spinning top forms on the chart. This could be followed by a down candle, indicating that the price may continue to fall further. However, the following candles may show a reversal, as the price could start moving upward.

Sideways Movement: If the price is moving within a range and a spinning top forms, it confirms that the market is uncertain, and the price will likely continue to trade sideways.

Post-Advance Reversal: A spinning top that forms after a significant price advance may signal that the trend is losing strength. If followed by a strong bearish candlestick, the spinning top could indicate a reversal to the downside.

These examples demonstrate how important it is to analyze the context and follow-up candles to assess the true meaning of a spinning top pattern.

Limitations of the Spinning Top Pattern

Although the spinning top is a useful pattern in technical analysis, it has some limitations:

Frequency of Occurrence:

Spinning tops are common patterns in candlestick charts, especially during periods of market consolidation or indecision. They often appear when the market is already moving sideways or is about to start consolidating, which can limit their predictive power.

Lack of Guarantee:

Even if a spinning top is followed by a confirming candle, there is no guarantee that the price will continue in the predicted direction. Market conditions can change quickly, and other factors such as news events or fundamental changes can influence the price.

Risk of High Stop-Loss Placement:

Because spinning tops can have large ranges, placing a stop-loss above or below the extreme high or low of the spinning top may result in significant risk. The reward may not justify the potential loss, so traders need to carefully assess the risk-to-reward ratio when trading with this pattern.

No Price Target or Exit Strategy:

Spinning tops do not provide a clear price target or exit plan. Therefore, traders should rely on other tools or strategies to help them determine exit points. This could include using other candlestick patterns, trendlines, or technical indicators.

Is a Spinning Top Bullish or Bearish?

The spinning top pattern can signal either a bullish or bearish reversal depending on its placement in the trend:

Bullish Reversal: If a spinning top forms at the bottom of a downtrend, it could indicate that the bears are losing control and that the bulls are preparing to take over.

Bearish Reversal: If a spinning top forms at the peak of an uptrend, it may indicate that the bulls are losing control, and the market could reverse downward.

Spinning Top vs. Doji Candlestick

Both spinning tops and doji candlesticks represent indecision in the market, but they have key differences:

Spinning Top: A spinning top has a small real body with long upper and lower shadows, indicating significant price movement during the period but no clear trend direction.

Doji: A doji has a very small real body, with the opening and closing prices being almost identical. The shadows can be short or long, but the lack of a body emphasizes the balance between supply and demand.

Both patterns require confirmation from subsequent candles to signal a potential trend reversal or continuation.

What is a Candlestick?

A candlestick is a charting tool used in technical analysis to represent price movement over a specific time period. Each candlestick displays four key values: the opening price, closing price, highest price, and lowest price during the time period. The wide part of the candlestick, known as the real body, shows the difference between the opening and closing prices. The thin lines extending above and below the real body are called wicks or shadows, and they represent the highest and lowest prices during the period.

Wrapping Up

The spinning top candlestick pattern is an important tool for traders to gauge market sentiment and potential price direction. It signals indecision and a struggle between buyers and sellers, and its significance is amplified when confirmed by the subsequent candlestick. By understanding the pattern’s key characteristics, traders can use it to identify potential reversals or consolidations, making it a valuable addition to any trader’s toolkit. However, like all candlestick patterns, the spinning top should be used in conjunction with other technical analysis tools and indicators to increase its reliability and effectiveness.