Budget-2025-at-a-Glance-Key-Highlights-and-Sectoral-Allocation

OtherIntroduction: Charting India’s Economic Path

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, outlines a strategic roadmap for India’s economic growth. This budget focuses on reinforcing growth through targeted investments, fiscal discipline, and sector-specific incentives. Key priorities include strengthening infrastructure, boosting exports, generating employment, and improving the ease of doing business.

With revised income tax slabs, increased public spending, and policy-driven incentives, Budget 2025 is set to impact businesses, investors, and citizens significantly. Let’s explore the key highlights and implications of this budget.

Macroeconomic Outlook: Growth Projections & Market Sentiments

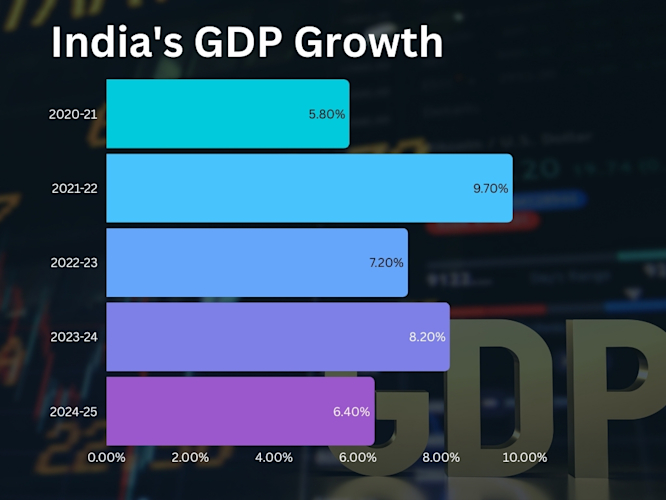

GDP Growth: The budget forecasts India’s GDP growth at 6.4% for FY25, in line with projections by the IMF and World Bank.

Global Comparisons: Despite being one of the fastest-growing economies, India’s growth rate is slightly lower than the previous year due to global economic challenges.

Key Growth Sectors: Infrastructure, manufacturing, technology, and renewable energy are expected to drive economic momentum.

Market Reactions: Positive market sentiment followed the announcement of tax relief and increased capital expenditure, with key stock indices showing an upward trend.

Fiscal Discipline: Managing Deficit, Revenue & Expenditure

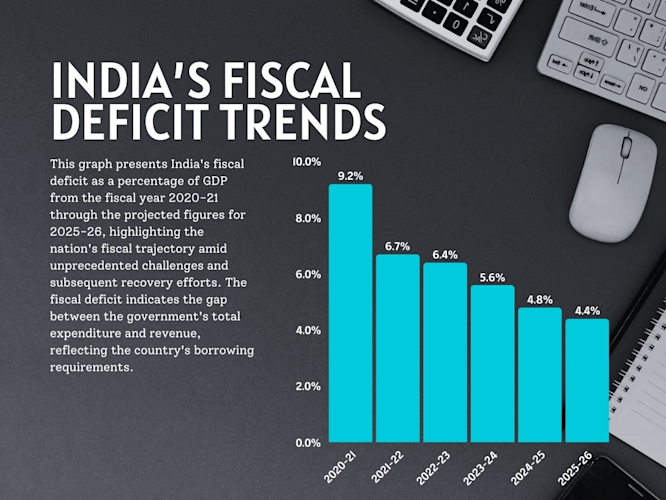

The government has set a fiscal deficit target of 4.8% for FY25, with plans to reduce it to 4.4% by FY26. Key strategies include:

Rationalizing subsidies and improving tax compliance.

Increasing privatization revenues and asset monetization.

Introducing a ₹1.5 lakh crore interest-free loan scheme for states to boost capital expenditure.

Budgetary Breakdown: Revenue Sources & Spending Priorities

Revenue Sources:

Direct & Indirect Taxes: Revised tax slabs and enhanced compliance measures aim to widen the tax net.

Disinvestment & Privatization: The government targets ₹2 lakh crore through PSU stake sales and asset monetization.

Foreign Investments: FDI reforms, including a 100% FDI limit in the insurance sector, aim to attract global investors.

Expenditure Priorities:

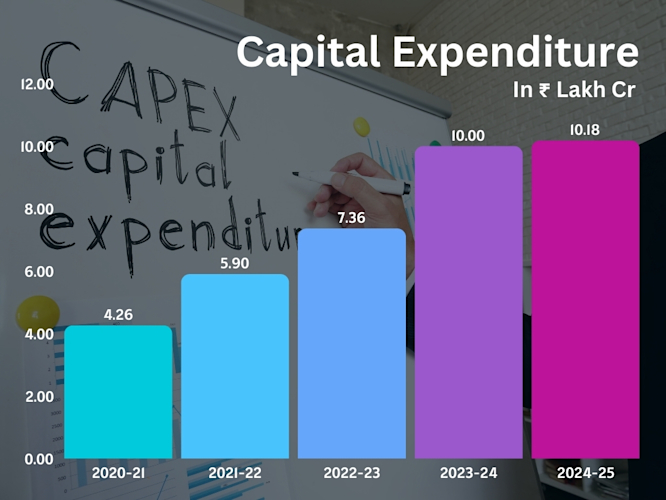

Infrastructure & Capex: Record-high capital expenditure allocation.

Healthcare & Social Welfare: Expansion of Ayushman Bharat and rural health initiatives.

Defense: Increased funding for modernization and procurement.

Infrastructure & Capex: Investing in Growth & Development

A massive ₹10 lakh crore has been allocated for capital expenditure, focusing on railways, roads, and smart cities.

Public-Private Partnerships (PPP): Enhanced participation in transport, logistics, and power sectors.

Employment Generation: Infrastructure projects are expected to create over 2 million jobs, particularly in the construction sector.

Industry-Wise Budget Allocation: Winners & Key Reforms

Manufacturing: Expansion of Production Linked Incentive (PLI) schemes to boost domestic production.

MSMEs & Startups: ₹50,000 crore allocated for credit support and simplifying business operations.

Exports & Global Trade: Introduction of ‘BharatTradeNet,’ a digital platform to streamline export processes.

Sectoral Focus: Key Industries & Budgetary Priorities

Agriculture:

Launch of the Dhan Dhanya Krishi Yojna to promote sustainable farming and exports.

Establishment of the Makhana Board in Bihar to add value to local produce.

Healthcare:

Full exemption of basic customs duty on 36 lifesaving drugs.

Expansion of Ayushman Bharat to cover more beneficiaries.

Education & Skilling:

Establishment of 5 National Centres of Excellence for Skilling.

Infrastructure expansion in IITs established after 2015, adding 6,500 new seats.

Defense:

Increased focus on indigenous defense manufacturing.

Higher budget allocation for modernization and procurement.

Renewable Energy:

Significant push for solar, wind, and green hydrogen projects.

Tax incentives for companies investing in sustainable energy solutions.

Digital & IT:

Creation of a Centre of Excellence for AI in Education with a ₹500 crore allocation.

Enhanced funding for cybersecurity and digital public infrastructure.

New Income Tax Slabs: Relief for Individuals

One of the most anticipated announcements in Budget 2025 was the revision of income tax slabs, aimed at providing relief to individual taxpayers and boosting disposable income. The new tax structure is designed to simplify the tax regime while reducing the burden on middle-income groups.

Here’s a breakdown of the new income tax slabs for FY25:

Conclusion: Key Takeaways & Future Outlook

Budget 2025-26 strikes a balance between growth, social welfare, and fiscal responsibility. Key highlights include:

Individuals with a net taxable income of up to ₹12 lakh are eligible for a full rebate, resulting in zero tax liability under the new tax regime.

A record ₹10 lakh crore allocation for infrastructure and capital expenditure.

Introduction of the Deep Tech Fund to support startups and innovation.

Increased FDI limits and trade incentives to attract global investments.

Challenges & Opportunities:

Balancing fiscal discipline with high public expenditure remains a challenge.

Global economic uncertainties may impact India’s export growth.

The long-term success of the budget depends on effective implementation and governance.

Vision Ahead: Budget 2025 aligns with India’s ambition to become a global hub for manufacturing, technology, and innovation. Its success will hinge on timely execution and efficient governance, paving the way for sustained economic growth and development.