Delta Neutral Strategy: Definition, Use in a Portfolio, and Example

Trading Strategies

Key Conclusions:-

Delta neutral strategy is a portfolio approach that uses numerous positions to balance positive and negative deltas, resulting in an overall delta of zero.

A delta-neutral portfolio evens out the response to market fluctuations across a specific range, bringing the net change of the position to zero.

Options traders use delta-neutral approaches to profit on implied volatility or temporal decay of options.

Delta-neutral techniques are frequently employed for hedging purposes.

What Is Delta Neutral Strategy?

Delta neutral is a portfolio strategy in which various investments balance positive and negative deltas, resulting in an overall delta of zero. Options traders use delta-neutral methods to profit on implied volatility or option time decay. These tactics are also useful for hedging. We will describe this approach in detail for both rookie and expert traders.

Understanding Delta Neutral strategy.

Understanding the notion of delta is critical in options trading. Delta, one of the "Greeks" of finance, calculates how sensitive an option's price is to changes in the price of the underlying asset. More specifically, delta calculates how much an option's price is likely to fluctuate for every $1.00 change in the price of the underlying security. For example, a call option with a delta of 0.25 and a value of $1.40 would be expected to be worth $1.65 if the underlying asset increased by $1.00.

Depending on the holdings maintained, a portfolio's delta may be positive, negative, or neutral.

1. Positive delta: A positive delta indicates that the option's price is projected to rise as the underlying asset's price rises. This is frequently the case with call options or a bullish position on a stock.

2. Negative delta: A negative delta indicates that the option's price will fall as the underlying asset's price rises. This is frequent with put options or a pessimistic outlook on a stock.

Investors wanting a delta-neutral portfolio aim to balance these deltas so that the overall delta of the portfolio is zero. This balancing act ensures that modest, incremental changes in the underlying asset price have no impact on the portfolio. However, huge price fluctuations, volatility changes, and time can all have an impact on the portfolio's value. Getting to delta neutral frequently requires making continuous adjustments since the delta can shift away from zero due to market developments.

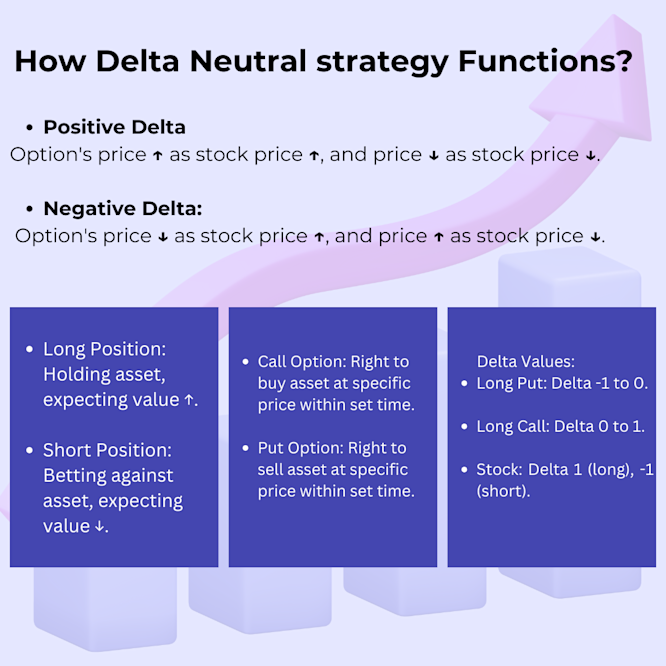

How Delta Neutral strategy Functions?

A positive delta indicates that the option's price will increase when the stock price rises and fall when the stock price falls. A negative delta, on the other hand, suggests that the option's price will rise and fall in tandem with the stock price. Before we set out this plan, let's define a few additional concepts.

Long and short positions: A long position means that you hold the asset and believe its value will rise over time. In contrast, a short position indicates that you are betting against the asset and expect it to fall.

Call and Put options: Call and put options are two forms of option contracts. A call option grants the holder (buyer) the right to purchase an asset at a certain price within a specific time frame. A put option gives the holder the right to sell an asset at a defined price within a certain time period.

Values of delta: Long put options have deltas ranging from -1 to 0, but long calls always have a delta ranging from 0 to 1. The underlying asset, which is usually a stock, always has a delta of one if the position is long and -1 if it is short. A combination of negative and positive values would reduce the delta to zero overall.

We can now look at how a delta-neutral strategy, with a delta of zero, would work. Assume you have a long position in a stock (delta = +1). To make this position delta neutral, purchase a put option on the same stock (delta range: -1 to 0). This is observed with deep-in-the-money call options. If the stock price rises by $1, the long position gains $1 (because to the +1 delta). However, the price of the put option will fall, offsetting the gain from the long position. This ensures that the overall value of the portfolio remains constant regardless of how much the stock price changes.

Similarly, if an option has a delta of zero and the stock climbs by $1, the option's price will not rise at all (as seen with deep out-of-the-money call options). If an option has a delta of 0.5, its price rises by $0.50 for every $1 increase in the underlying stock. This is due to the delta (0.5) being multiplied by the change in the stock price ($1), resulting in a $0.50 change in the option price.

An Example of Delta-Neutral Hedging

Assume you own 200 shares of Company X, trading at $100 a share, and you feel the stock will rise in value over time. You are concerned, however, that prices may fall in the short run, so you establish a delta-neutral position to hedge this directional risk. Being long 200 shares of stock indicates that your delta is +200. You can discover options contracts with the opposite delta exposure to cancel it out (i.e., -200).

Assume you locate an at-the-money put option on Company X with a delta of -0.50. The sign is negative because put options gain value when the underlying price falls and lose value when it rises. Stock options represent 100 shares of the underlying asset, therefore purchasing one Company X put gives you the following: -0.50 x 100 equals -50 deltas. If you purchased four of these put options, your total delta would be -200, calculated as 400 × -0.5. With 200 Company X shares and long-4 at-the-money put options on Company X, your entire position is not zero, i.e. delta neutral.

Note: While an initial delta hedge can establish a neutral position, when the underlying stock changes, so will the delta of the options employed. This is referred to as the option's gamma. As a result, traders seeking to maintain delta neutrality must monitor and alter their holdings to re-establish cancelling deltas. The approach is known as dynamic hedging.

Pros and Cons of Delta Neutrality.

Pros:

1. Hedges against minor price fluctuations in either way.

2. Allows option traders to focus on non-directional techniques.

3. Flexibility in establishing delta neutral locations.

Cons:

1. Large, abrupt movements might result in directional exposure due to gamma.

2. Monitoring and making adjustments can be costly and time-consuming.

The fundamental advantage of a delta-neutral position is that it is resistant to modest fluctuations in the price of the underlying asset, whether up or down. This technique focuses on betting on the direction of the stock price rather than worrying about tiny price swings. Delta-neutral traders frequently seek to profit from the time decay of options (expressed by the Greek theta) or changes in implied volatility (represented by the Greek vega), rather than directional stock movements. Since delta neutrality concentrates on offsetting price movement risks, traders can concentrate on the other elements influencing the option's value.

However, being delta neutral implies missing out on those price changes, which creates an opportunity cost for certain traders. Even if you are unconcerned about these price fluctuations, keeping a delta-neutral position while the underlying moves necessitates active monitoring and adjusting, which can be expensive and unsuitable for beginning traders. Furthermore, major unexpected market moves might result in significant losses because the position is only neutral to tiny price movements. As a result, big and unexpected market occurrences can jeopardize the approach.

Delta Hedging: How Does It Work?

Delta hedging reduces the directional risk associated with fluctuations in the price of the underlying asset by utilizing offsetting positions in options contracts. This is often accomplished by purchasing or selling options with equal but opposite exposure to the underlying asset. This will offset gains (losses) in the underlying asset with equal losses (gains) in the options position.

Is it possible to be Delta Neutral by using either calls or puts?

Yes. If you own stock, you can buy and sell puts and calls. You can also establish delta-neutral positions using only options, such as being long an at-the-money straddle in which you buy one +0.50 delta call and one -0.50 delta put.

How Can Options Traders Profit from Delta Neutral Positions?

Options traders can earn from delta-neutral positions by selling options and collecting the time decay as it occurs. This method can be sharpened by eliminating exposure to tiny price changes. Similarly, traders can wager on whether the underlying asset's volatility will rise or decline in the future. A delta-neutral position enables the trader to separate the volatility statistic from the market direction.

To sum up

Delta neutrality arises when a trader's net holdings are hedged against fluctuations in market price, whether up or down. This is accomplished by offsetting the deltas of one financial instrument with those of others. This balance implies that minor changes in the underlying asset's price will have little to no effect on the overall value of the combined position (for example, shares plus options). The notion is that the gain on one side of the position balances out the loss on the other. However, keep in mind that delta is not constant; it varies with market movement (gamma) and time. As a result, sustaining a delta-neutral position frequently necessitates ongoing modifications, known as dynamic hedging.