Are-HML-stocks-considered-growth-stocks

Stock Market Basics

Are HML stocks considered growth stocks?

No, HML (High Minus Low) is not synonymous with growth stocks. Rather, HML is a factor within the Fama-French Three-Factor Model, which evaluates the variance in returns between value stocks and growth stocks. Specifically, it measures the excess returns of value stocks—companies with a high book-to-market ratio—over growth stocks, which have a low book-to-market ratio. Thus, growth stocks do not fall under the category of value stocks that HML primarily addresses.

Understanding the Fama-French Three-Factor Model

The Fama-French Three-Factor Model expands on the foundational principles of the Capital Asset Pricing Model (CAPM). It introduces three key factors to describe and predict stock returns more effectively:

Market Risk Premium: The gap between the expected return on the market and the risk-free rate.

SMB (Small Minus Big): The historical outperformance of small-cap companies relative to large-cap companies.

HML (High Minus Low): The historical outperformance of value stocks over growth stocks.

This model, introduced by University of Chicago professors Eugene Fama and Kenneth French, refines the understanding of stock performance and demonstrates that small-cap and value stocks consistently outperform the broader market over the long term.

Origins and Expansion of the Model

Initially, the model was developed using data from four key markets: the U.S., Canada, Japan, and the U.K. Over time, Fama and French adapted the model to apply to other regions, including Europe and the Asia-Pacific, making it a global tool for stock performance analysis. Its applicability has expanded significantly, as the foundational principles have proven consistent across various economic landscapes.

Formula of the Fama-French Three-Factor Model

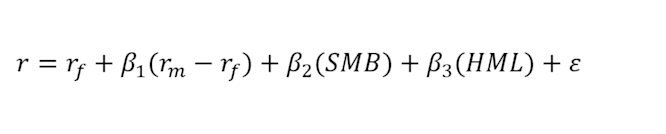

The Fama-French Three-Factor Model is mathematically expressed as:

Where:

r = Expected rate of return

rf = Risk-free rate

ß = Factor’s coefficient (sensitivity)

(rm – rf) = Market risk premium

SMB (Small Minus Big) = Historic excess returns of small-cap companies over large-cap companies

HML (High Minus Low) = Historic excess returns of value stocks (high book-to-price ratio) over growth stocks (low book-to-price ratio)

↋ = Risk

Components of the Model

1. Market Risk Premium

This factor calculates the difference between the expected market return and the risk-free rate. It compensates investors for taking on market volatility beyond a risk-free asset.

2. SMB (Small Minus Big)

SMB represents the size premium, highlighting that small-cap companies tend to deliver higher returns compared to their large-cap counterparts over time. By identifying SMB, investors can quantify its impact using a beta coefficient derived through regression analysis.

3. HML (High Minus Low)

HML quantifies the value premium, representing the return differential between high book-to-market value companies (value stocks) and low book-to-market value companies (growth stocks). Like SMB, the HML beta coefficient can vary, taking positive or negative values based on historical performance data.

Why the Fama-French Model Matters

The Fama-French Three-Factor Model enhances CAPM by accounting for additional dimensions of stock performance. Its flexibility stems from the inclusion of two extra factors beyond market risk, making it a robust tool for analyzing diversified portfolios. Research indicates that the model explains over 90% of the variance in diversified portfolio returns.

Key Insights:

Small-cap companies generally outperform large-cap companies.

Value stocks, with high book-to-market ratios, tend to outperform growth stocks over the long term.

The model’s risk-return framework assumes that higher-risk investments demand higher expected returns.

HML and Growth Stocks: A Clear Distinction

To clarify the question, "Are HML growth stocks?": No, they are not. Growth stocks are characterized by their low book-to-market ratios, signifying that they do not align with the "value" category HML targets. Instead, HML evaluates the differential returns between value and growth stocks, showcasing the consistent long-term outperformance of value stocks. This distinction is crucial for accurate application of the Fama-French model.

Illustrating the Difference

Growth stocks typically invest heavily in innovation, often foregoing short-term profits in favor of long-term potential. For example, technology companies in their early stages are common growth stocks. Conversely, value stocks often represent mature companies with stable cash flows and undervalued market positions, such as industrial or energy sector firms. The HML factor thus emphasizes the historical preference for value over growth in terms of realized returns.

Advancements in the Fama-French Model

Four-Factor and Five-Factor Models

Since the original three-factor model, additional dimensions have been introduced. These include profitability factors (e.g., robust versus weak operating profitability) and investment factors (e.g., conservative versus aggressive investment strategies). These updates aim to further refine the accuracy of portfolio analysis and return prediction.

Global Applicability

The model’s evolution also accounts for regional differences, making it more effective in capturing nuances across markets worldwide. For instance, adaptations consider the unique market behaviors in Asia-Pacific or Europe compared to North America.

Sectoral Impacts

Another advancement involves sectoral analysis. The performance of HML, for example, may differ significantly in technology-focused sectors versus traditional manufacturing industries, reflecting varying market dynamics and investor behaviors.

Limitations of the Model

Although the Fama-French Three-Factor Model offers valuable insights, it has its limitations:

Exclusion of Momentum: Momentum, a critical factor in modern portfolio theory, is not included in the model. This led to the creation of the Carhart Four-Factor Model, which incorporates momentum.

Assumption of Linear Relationships: The model assumes linear relationships between factors and returns, which might oversimplify complex market dynamics.

Historical Basis: The reliance on historical data for SMB and HML may not always reflect future trends.

Limited Factors: Despite its sophistication, the model does not account for macroeconomic variables like interest rates or inflation.

Market Anomalies: Factors such as geopolitical events, technological disruptions, or extreme market conditions can create anomalies not captured by the model.

Practical Applications

Portfolio Management

The model’s factors enable asset managers to better understand portfolio risks and returns. By dissecting the contributions of market risk, size, and value premiums, they can construct portfolios tailored to specific risk-return profiles.

Stock Selection

Investors can leverage SMB and HML factors to identify undervalued stocks or small-cap opportunities poised for growth. For instance, during periods of economic recovery, value stocks often become attractive due to their perceived stability and growth potential.

Risk Assessment

By quantifying the impact of different factors, the model enhances risk assessment, helping investors make more informed decisions. For example, high HML exposure might indicate a portfolio’s susceptibility to underperformance during growth-led market rallies.

Case Studies

In the aftermath of the 2008 financial crisis, portfolios with strong HML tilts outperformed growth-oriented strategies as investors sought undervalued opportunities. Similarly, during the tech boom of the late 1990s, growth stocks outshone value stocks, highlighting the importance of context when applying the model.

Future of Factor-Based Investing

As markets evolve, factor-based investing continues to gain traction. Extensions of the Fama-French model reflect this trend, incorporating new dimensions to capture emerging market behaviors. The ongoing research into machine learning and AI also holds potential for integrating dynamic, real-time factors into investment models.

Technological Integration

AI-driven models can analyze vast datasets to refine factor sensitivity and predict market shifts. For instance, real-time tracking of economic indicators might dynamically adjust SMB and HML coefficients, enhancing predictive accuracy.

Sustainability Factors

Environmental, social, and governance (ESG) considerations are increasingly influencing investment decisions. Future iterations of the Fama-French model might incorporate ESG factors to reflect changing investor priorities.

While HML is a vital component of the Fama-French Three-Factor Model, it measures the performance gap between value and growth stocks rather than categorizing growth stocks themselves. Understanding this distinction is crucial for investors aiming to leverage the model for enhanced portfolio performance. By embracing the insights of the Fama-French model and its extensions, investors can navigate the complexities of modern financial markets with greater precision and confidence.

The model’s enduring relevance lies in its ability to adapt to evolving market conditions while providing a robust framework for analyzing risk and return. As technology and market dynamics continue to evolve, the principles of the Fama-French model remain a cornerstone of modern portfolio theory, guiding investors toward informed and strategic decision-making.