Unveiling Long-Term Nifty Returns: The Impact of Time Horizons

Stock Market Basics

Explore how Nifty returns differ significantly based on varying time horizons and entry points. Our comprehensive study highlights the risks of short-term strategies and emphasizes the strength of a long-term perspective. Learn how early market experiences influence not only our expectations for returns but also our risk perception. Ultimately, understand why the timeless advice for investors should always be, "this too shall pass."

For investors in the Indian stock market, grasping the behaviour of returns over various time horizons is crucial for optimizing profits and reducing regret. A thorough analysis of the Nifty index’s annualized forward returns provides essential insights into the complex relationship between entry timing, market cycles, and investment durations.

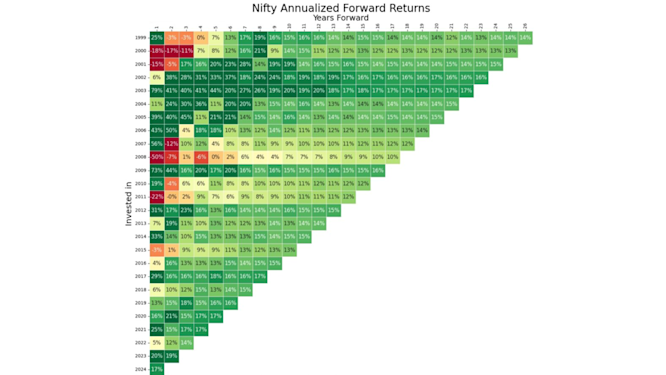

The chart illustrates the annualized returns from investing in the Nifty Total Returns Index (which accounts for dividends) at the beginning of each year since its inception. Each column represents the annualized return for 1, 2, 3 years, and so on, based on investments made in the corresponding row's year. This format allows for easy comparison of annualized returns over the same period for different investment years. For instance, the "10" column displays the 10-year annualized return for investments made each year from 1999 to 2015. Investments made after 2015 are not yet eligible for the 10-year return, so those entries remain blank.

The Risks and Opportunities of Entry Timing

The data clearly demonstrates the significant influence that entry timing can have on investment returns, particularly in the short term. Investors who entered the market at peaks, such as right before the 2008 financial crisis, faced considerable losses in the subsequent years as their portfolios declined in value. In contrast, those who strategically or fortuitously invested during market corrections or after downturns often experienced substantial gains as the market recovered.

One Market, Many Realities

Investors beginning their journeys at different historical moments would have perceived risk and returns quite differently within just a few years. Let's examine the early experiences of five investors across time.

The 2000 "The Market is Manipulated" Investor

For the investor who started in the year 2000, it was a tumultuous period. The burst of the dot-com bubble followed by the 2001 crash quickly dampened any initial excitement. After three years, this investor remained significantly in the red before beginning a recovery in 2004, which yielded a modest return of 7%. The early setbacks left lasting scars, making this investor perpetually cautious.

The 2003 "Double Every 2-3 Years, At Least" Investor

The investor entering in 2003 benefited from several years of remarkable returns as the market rebounded. After 3-4 years, this investor viewed stocks as an exhilarating avenue for quick wealth accumulation, potentially leaving them unprepared for the harsh realities of the 2008 crash and its aftermath.

The 2008 "Even Break-even is Bliss" Investor

For the investor who entered just before the financial crisis in 2008, it was a harsh initiation. Watching their portfolio plummet early on was a true test of perseverance. The market sank nearly 60% in the first year of their investment, but then began to recover in 2009, only to remain flat for the next two years, leaving this investor uncertain about future market expectations.

The 2018 "Lucky if You Beat Inflation" Investor

The investor starting in 2018 came into the market with a sense of confidence following several years of solid returns. She anticipated high double-digit gains, perhaps even more, if she could identify the right mid- and small-cap investments. However, 2018 proved to be disastrous for small caps, while the Nifty managed to stay afloat. After nearly two years of lackluster performance, the 2020 pandemic crash further prompted this investor to seek the safety of fixed deposits.

The 2020 "BTFD or Bust" Investor

The investor who entered the market in 2020 faced a unique challenge, as a pandemic-induced correction led to a 40% drop in prices within weeks. This unprecedented uncertainty tested even seasoned market veterans. However, as money printing commenced, stocks and other assets experienced a rapid rally. The surreal remote-working environment provided few distractions, as investors kept a close eye on their brokerage accounts while attending Zoom meetings. Although stocks eventually lost some momentum as the world returned to normal, making money seemed deceptively easy.

Timing Matters: Impact on Returns and Risk Perception

When investors begin their journeys not only affects their returns but also reshapes their perception of risk.

The Guiding Principle for Long-Term Investors: "This Too Shall Pass"

A look at the overall graphic reveals that annualized returns tend to converge into a narrower range after the 10-year mark, despite the wild fluctuations in earlier years. Since these figures represent annualized returns, it suggests that significant gains or losses in one year are typically followed by movements in the opposite direction. Over time, extraordinary returns of 20-30% will naturally moderate. The takeaway is straightforward: if you experience significant gains early on, tempering your expectations for the next 2-3 years can help you avoid unrealistic net worth projections and subsequent disappointment.

Conversely, the initial years of meager returns are often followed by productive years that help normalize disparities between fortunate and unfortunate investors. This perspective should instill confidence in those building long-term portfolios.

Whether recent investment returns seem too good to be true or painfully difficult to endure, remember: "this too shall pass."

The Strategic Investor’s Practical Playbook

From these insights, a practical playbook emerges for the strategic investor:

Adopt a Long-Term Perspective

: Extend your investment horizon to 10+ years to mitigate volatility and leverage the market's inherent upward trajectory.

Diversify Over Time

: Utilize systematic investment plans (SIPs) or regular investments to navigate volatility and reduce the risk of poor entry timing.

Remain Invested During Downturns

: Treat market pullbacks as opportunities rather than threats. Having the ability to actively manage risk is a valuable asset.

Avoid Euphoria at Entry Points

: While perfect timing is unattainable, refrain from investing at overly optimistic market peaks and look for relative undervaluation.

Index When Unsure

: The consistent long-term returns of the Nifty make index funds a compelling core component for long-term portfolios.

As illustrated by investors’ experiences over the decades, the path to successful investing is often marked by short-term volatility and uncertainty. However, those who maintain a long-term outlook, adhere to disciplined strategies, and weather inevitable downturns are often rewarded handsomely.

While the short-term fluctuations in the market can be unsettling, history demonstrates that patience, discipline, and strategic investing are often the most reliable routes to long-term financial success. As the Nifty’s annualized return data compellingly illustrates, it’s not merely about timing the market; it’s about the time you dedicate to the market that truly makes a difference.

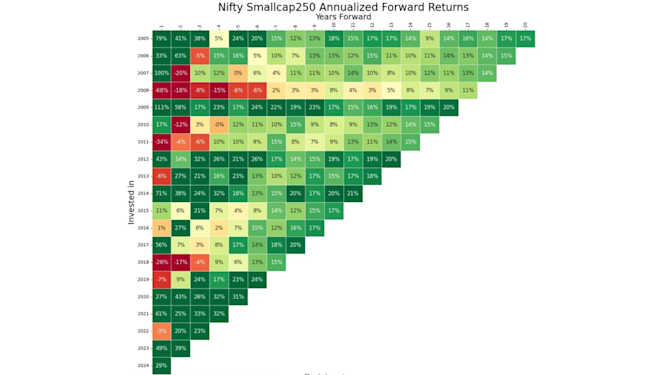

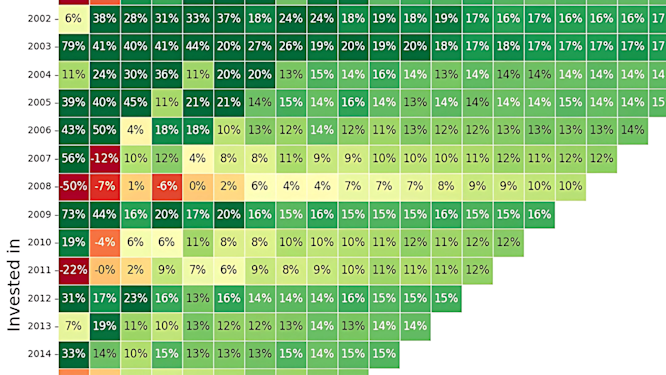

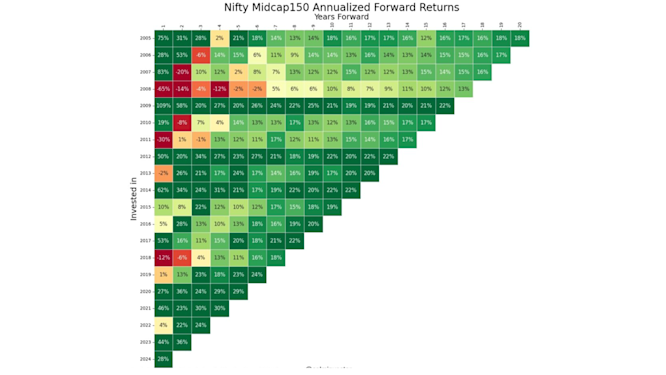

Appendix – Midcaps

Appendix – Smallcaps