Navigating Market Declines: Insights and Strategies for Investors

OtherThe Indian stock market is currently experiencing significant corrections, presenting a mix of challenges and opportunities for investors. Examining the indices reveals patterns that can guide thoughtful, long-term investment decisions.

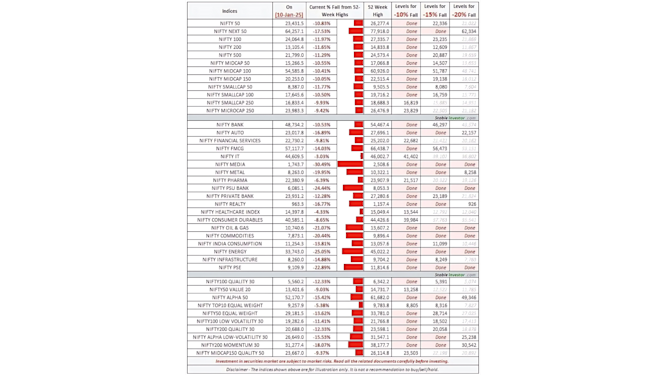

Performance of Major Indices

The Nifty 50, a prominent benchmark index, has dropped by 10.83% from its 52-week peak, reflecting a consolidation phase. Broader indices have seen sharper declines, with the Nifty Smallcap 250 experiencing a 13.95% drop. This suggests smaller-cap stocks are facing steeper corrections compared to their large-cap peers. These trends indicate the growing divergence in performance based on market capitalization, and for investors, it’s essential to weigh risks against potential returns.

The midcap segment has also encountered corrections, with indices like the Nifty Midcap 150 dropping by 10.45%. These shifts underscore the importance of assessing market segments individually, as midcaps often act as a bridge between the stability of large-caps and the growth potential of small-caps.

Sector-Specific Trends

Certain sectors have faced significant downturns, making it vital for investors to closely analyze sectoral performance:

Nifty Metal: Down 19.95%, likely due to global commodity demand fluctuations and softening metal prices, which tend to be cyclical in nature.

Nifty PSU Bank: Witnessed a steep 24.44% drop, reflecting investor hesitancy in the public banking sector, which may have been influenced by concerns over asset quality and profitability.

Nifty Realty: Declined by 16.96%, indicating cautious sentiment in the real estate domain. This could be tied to rising interest rates, impacting home loans and demand for residential properties.

Other sectors have shown relative resilience. For example:

Nifty IT: Declined by just 3.03%, demonstrating stability despite global macroeconomic uncertainties. This sector’s limited correction may be attributed to consistent demand for IT services and technological advancements.

Nifty FMCG: Dropped by 10.43%, showcasing the defensive nature of this sector, driven by consistent consumer demand for essential goods.

Trends in Factor-Based Indices

Investment strategies focusing on specific factors have also experienced turbulence:

Nifty200 Momentum 30: A decline of 18.07%, highlighting the challenges faced by momentum strategies, which typically rely on rising stock prices.

Nifty Alpha 50: Down 15.42%, reflecting the difficulty of consistently outperforming the broader market in uncertain conditions. Alpha-driven strategies often struggle during high volatility as correlations between stocks increase.

Nifty Low Volatility 30: Declined by 11.41%, indicating even traditionally less volatile stocks have not been immune to corrections, though the impact has been relatively contained.

Lessons for Investors

Corrections, while unsettling, provide a unique opportunity to revisit investment strategies and prepare for future market upswings. Here’s why these phases are significant:

Attractive Valuations: During corrections, stock prices often fall faster than their earnings potential, creating opportunities to buy quality stocks at discounted prices.

Potential for Recovery: Historically, downturns have preceded periods of robust market growth. For patient investors, staying invested through volatility often pays off in the long term.

Rebalancing Opportunities: Corrections allow investors to realign their portfolios, focusing on sectors or stocks that may offer better growth potential while shedding underperforming assets.

Contrarian Investing: This is a time for contrarians to explore sectors like metals and PSU banks, which, while currently underperforming, may offer significant upside as market conditions stabilize.

Key Strategies for Navigating Corrections

Here are some actionable steps for investors during turbulent times:

Diversify Your Portfolio: Spreading investments across sectors, asset classes, and market caps can help reduce risk and ensure steady performance over time.

Focus on Fundamentals: Companies with robust balance sheets, consistent cash flows, and strong business models tend to weather downturns better. Identifying such opportunities can lead to long-term gains.

Maintain Discipline: Emotional decision-making, such as panic selling, can erode portfolio value. Sticking to a well-defined investment plan is critical.

Leverage SIPs: Systematic Investment Plans (SIPs) in mutual funds or equities allow investors to take advantage of rupee cost averaging, effectively lowering the average cost of investments during market dips.

Sectoral and Market-Cap Insights

Analyzing sectoral trends provides clarity on where opportunities may lie:

Information Technology: The limited correction in the Nifty IT index reflects the sector’s robustness. Investors may consider this sector for its potential to provide stability amid broader volatility.

FMCG: As a defensive sector, FMCG continues to be a reliable option for those seeking consistent returns and lower volatility.

Metals and Real Estate: High-risk sectors like metals and real estate have faced steep corrections, but they may offer substantial upside as the economy recovers.

Small and Midcaps: These segments, while riskier, have historically delivered superior returns in recovery phases. Selective investments in high-growth small-cap and mid-cap stocks could prove rewarding.

Long-Term Perspective: A Critical Factor

While short-term corrections can create uncertainty, adopting a long-term perspective is crucial. Over time, equity markets have consistently outperformed other asset classes, driven by economic growth and corporate profitability. For investors, focusing on long-term goals, such as retirement or wealth accumulation, can help weather short-term volatility.

The Bigger Picture

Market corrections are part of the natural cycle, often serving as a reset that enables sustainable growth. They offer investors the chance to:

Reassess Risk Appetite: Understanding your risk tolerance and aligning your portfolio accordingly is key during volatile times.

Reevaluate Financial Goals: This is a good time to revisit financial goals and ensure your investment strategy aligns with them.

Identify Emerging Trends: Economic shifts during corrections often give rise to new growth trends. Staying informed can help investors capitalize on these opportunities.

To sum up

Market corrections can feel daunting, but they also offer a chance to build wealth strategically. Whether through disciplined investing, sectoral analysis, or leveraging market volatility, investors have various tools at their disposal to navigate these challenging phases.

As the Indian stock market moves through this period of adjustment, it’s essential to focus on quality, diversification, and a clear long-term vision. By doing so, investors can not only mitigate risks but also position themselves for significant gains when markets rebound. Remember, corrections are temporary, but the benefits of prudent investing can last a lifetime.

img credit:https://www.linkedin.com/posts/rohangoyal99_nifty-crash-market-activity-7284411347084197888-YE7B?utm_source=share&utm_medium=member_desktop