All About the Rising Three Methods.

Stock Market Basics

In the dynamic realm of financial markets, traders and investors are always on the lookout for dependable signals to steer their actions. One potent candlestick pattern that has garnered attention is the “Rising Three Methods.” This pattern is highly regarded for its knack to indicate bullish trends and offer valuable insights into market sentiment.

In the expansive world of financial markets, grasping and employing strong technical analysis tools is essential for both traders and investors. Among the many patterns, the “Rising Three Methods” stands out. This overview seeks to illuminate the nuances of this bullish continuation pattern, offering a thorough understanding for newcomers and experienced market players alike.

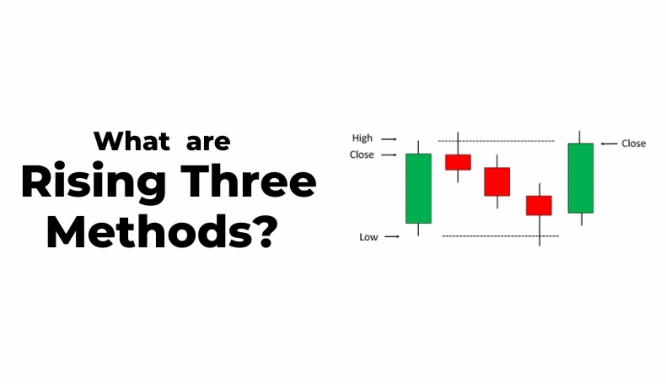

What are Rising Three Methods?

The Rising Three Methods candlestick pattern appears in an upward market trend, providing useful clues about the likelihood of bullish sentiment persisting. Made up of a series of particular candlesticks, this pattern visually depicts market behavior, indicating the strength of buyers even amidst small pullbacks.

Significance in Technical Analysis

Technical analysis serves as a guiding light for traders, aiding them in understanding market trends and making well-informed choices. Among these analytical tools, the Rising Three Methods pattern stands out as a potent means of recognizing and affirming bullish trends. As we explore the elements and details of this pattern, the subsequent sections will uncover its subtleties, enabling traders to utilize it effectively in their decision-making journey.

Understanding the components

The Rising Three Methods pattern unfolds through a series of distinctive candlesticks, each playing a crucial role in signaling and confirming a potential continuation of bullish momentum. Grasping these components is vital for traders aiming to harness the pattern's power in their technical analysis.

First Candlestick

The initiation of the Rising Three Methods pattern is marked by a strong, lengthy bullish candle. This candle symbolizes the ongoing uptrend, showcasing the dominance of buyers in the market. The size and strength of this initial candle set the tone for the pattern, indicating the prevailing bullish sentiment.

Second Candlestick

Following the robust bullish candle, the pattern introduces a sequence of three smaller bearish candles. These candles, typically forming a correction, indicate a temporary influx of sellers. It is critical to consider the magnitude and significance of these bearish candles in comparison to the preceding bullish candle, as this correction phase determines the pattern's overall dynamics.

Third Candlestick

The conclusion of the Rising Three Methods pattern features another lengthy bullish candle that surpasses the high of the first candle. This final candle reaffirms the dominance of buyers, signaling their resilience following the earlier correction. The culmination of this sequence reinforces the likelihood of the bullish trend persisting.

Identifying a Rising Three Methods Pattern

Identifying the Rising Three Methods pattern requires a discerning eye for specific candlestick sequences and a comprehension of associated price movements. Traders attempting to leverage this bullish continuation pattern must become familiar with the following components and attributes.

Pattern Formation

The Rising Three Methods pattern comprises three distinct candlesticks within an overarching uptrend. The first candlestick is a strong, lengthy bullish one, signaling ongoing buyer dominance. This is succeeded by a correction phase, where three smaller bearish candles emerge. Importantly, these bearish candles should not breach significant support levels, indicating a healthy correction rather than a trend reversal. The pattern concludes with another lengthy bullish candle surpassing the high of the first one, reaffirming the strength of the prevailing uptrend.

Price Movement Characteristics

Observing price movements during the formation of the Rising Three Methods pattern is crucial for accurate identification. Traders should monitor the correction phase, ensuring it remains within reasonable bounds without compromising the overall bullish trend. The corrective bearish candles should not undermine key support levels, while the subsequent bullish candle should demonstrate strength, signaling a resumption of upward momentum.

The Advantages and Disadvantages of trading with Rising three methods

In order to make an informed conclusion, traders must consider the benefits and drawbacks of trading the Rising Three Methods pattern.

Advantages:-

Clear Bullish Signal

A key benefit of the Rising Three Methods pattern is its ability to offer a clear bullish signal. The distinct sequence of candlesticks—beginning with a strong bullish candle, followed by a correction, and ending with another bullish candle—provides a visually compelling indication of potential bullish continuation. This clarity helps traders make timely and well-informed decisions.

Confirmation Potential

The Rising Three Methods pattern can complement other technical indicators or chart patterns, enhancing confirmation. By cross-referencing signals with tools like moving averages or relative strength indices, traders can bolster the reliability of the pattern, adding an additional layer of confirmation to their analysis.

Versatility Across Markets

Another advantage of the pattern is its versatility across various markets, including stocks, forex, and cryptocurrencies. Traders can apply the Rising Three Methods pattern across different financial instruments, making it a valuable tool regardless of the market they are trading in.

Limitations:-

False Signals

One of the main limitations of the Rising Three Methods pattern is the potential for false signals. Traders must be cautious of misinterpreting the correction phase or overlooking broader market conditions, as these factors can lead to inaccurate predictions To lessen the impact of misleading signals, put risk management techniques into practice and take into account additional confirmatory signs.

Market Volatility Sensitivity

The effectiveness of the pattern can be influenced by market volatility. In highly volatile conditions, the Rising Three Methods pattern may produce less reliable signals, and traders should be mindful of adjusting their strategies accordingly. Increased volatility can introduce unpredictability, affecting the pattern's ability to forecast bullish continuations accurately.

Not Foolproof

While the Rising Three Methods pattern is valuable, it is not foolproof. Traders should avoid relying solely on this pattern for decision-making and consider it as part of a broader analytical approach. Market dynamics can change rapidly, and the pattern should be used alongside other indicators and tools to strengthen overall analysis.